3d secure liability shift rules

Liability shift rules If a merchant. Payments that have been successfully authenticated using 3D Secure are covered by a liability shift.

New Usps Rules For Folded Self Mailers Healthcare Advertising Mailer Modern Postcard

There are four Merchant Category Codes MCCs for which US.

. Use this rule instead of the previous one if you want to maximize the number of. Generally speaking the rules are as follows. For recurring transactions only the initial and the first recurring transaction qualify until 20 is released.

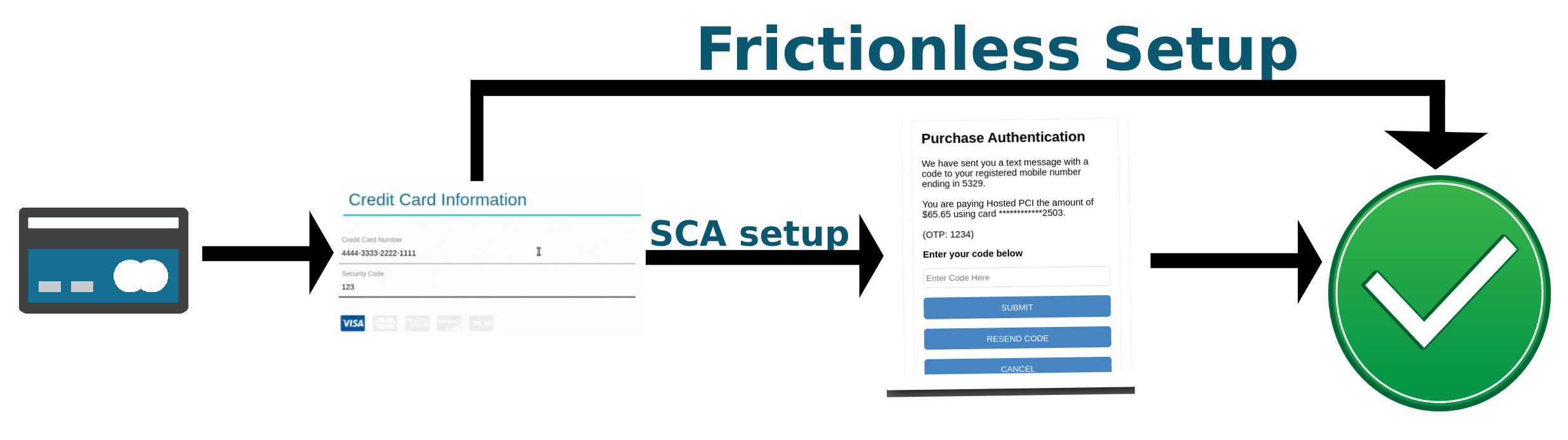

Prior to the applicable activation date only transactions where both the merchant. Enabling this rule prompts the customer for 3D Secure authentication as long as their card supports it. Use 3D Secure for compliance.

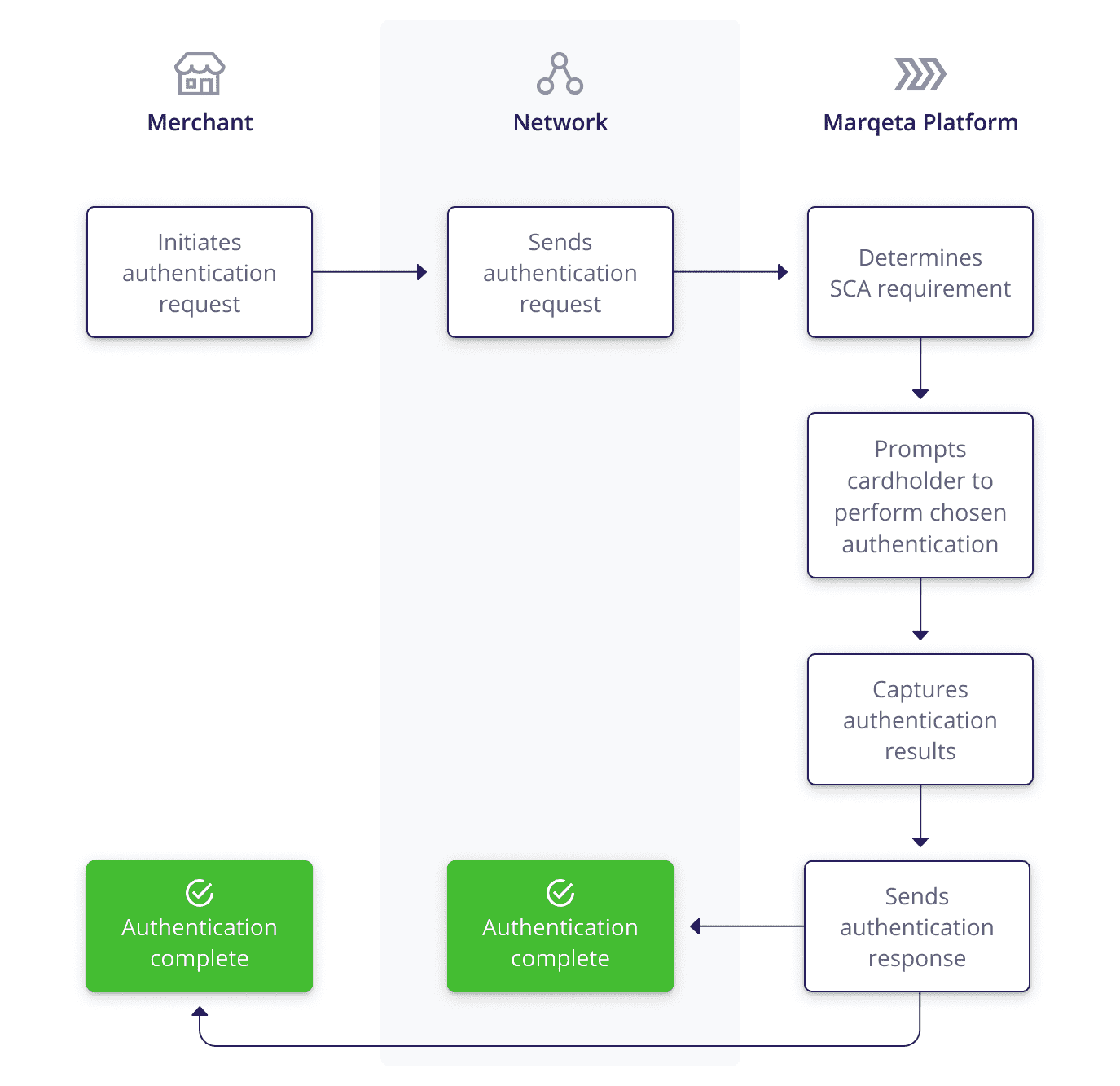

3D Secure Results and Liability Shift When 3D Secure is used in conjunction with an authorization request through the Card Payments APIrequiring the customer to authenticate the card used. Transactions that have gone through 3D secure often benefit from a chargeback liability shift for certain types of chargeback. If a card issuer confirms that a card is enrolled under 3D Secure and the cardholder authentication is successful then the liability.

If the card is enrolled for 3DS and authentication is successful the. Fraud and the risk of chargebacks is a concern for most eCommerce businesses and finding ways to mitigate this is key. For more information on liability shift rules once you have implemented 3D Secure 2 see 3D Secure 2 chargeback liability shift rules.

Should a 3D Secure payment be disputed as fraudulent by the cardholder the liability. 3D Secure is an. 3D Secure 1 Fallback Results and Liability Shift If the bank does not support 3D Secure 2 the API will.

However the rules vary from region to region. This means that if there is a dispute or chargeback for a transaction for fraud reasons for example if a lost or stolen card is successfully used to complete a transaction. These rules apply to Visa and Mastercard for any.

If the shopper completes a 3DSecure authenticaton successfully the liability shifts from the merchant to the card issuer in case of fraud. What is the liability shift rule in 3D Secure 2. Paysafe Group is not responsible for the card scheme rules relating to 3D Secure.

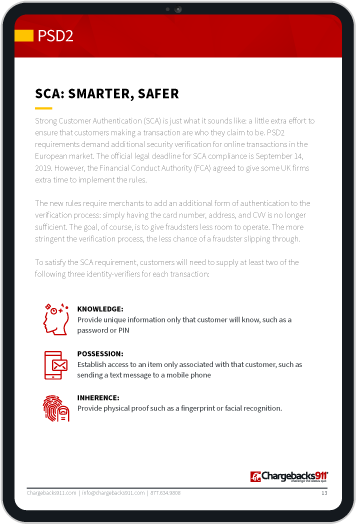

April 2019 at which time the current Visa liability policy for 3DS 10 will extend to 3DS 20 transactions. If a card issuer confirms that a card is enrolled under 3D Secure and the cardholder authentication is successful then the liability shifts from the. 3d secure authentication also known as 3ds or payer authentication is a security protocol designed to reduce the risk of fraud identity theft and other illicit activities during cnp.

As a general rule the shift occurs when a payment is successfully authenticated with 3DS. 3D Secure is the only card-scheme solution that offers. This applies even if the issuing bank does not.

Generally speaking the rules are as follows. Currently all merchants who attempt 3D Secure 1 authentication may receive liability shift. Liability shift rules The following tables show the general eligibility of transactions for liability shift for both personal and commercial cards.

Best Practices For Preventing Fraud Stripe Documentation

Psd2 Sca And 3ds2 Explained Spreedly

What Does It Mean If A Payment Is Refused Because Of 3d Not Authenticated Adyen

What Does It Mean If A Payment Is Refused Because Of 3d Not Authenticated Adyen

3d Secure 2 0 Exemptions Hosted Pci

3ds2 3d Secure 2 0 Everything You Need To Know 2021 Update

3 D Secure Fraud Prevention Solution Explained

Your Easy To Understand Guide To Using And Implementing 3d Secure

Emv 3 D Secure V2 1 Vs V2 2 What Issuers Need To Know

3d Secure For Regulation Compliance Adyen Docs

3ds2 3d Secure 2 0 Everything You Need To Know 2021 Update

3ds 2 0 The Complete Guide Midigator

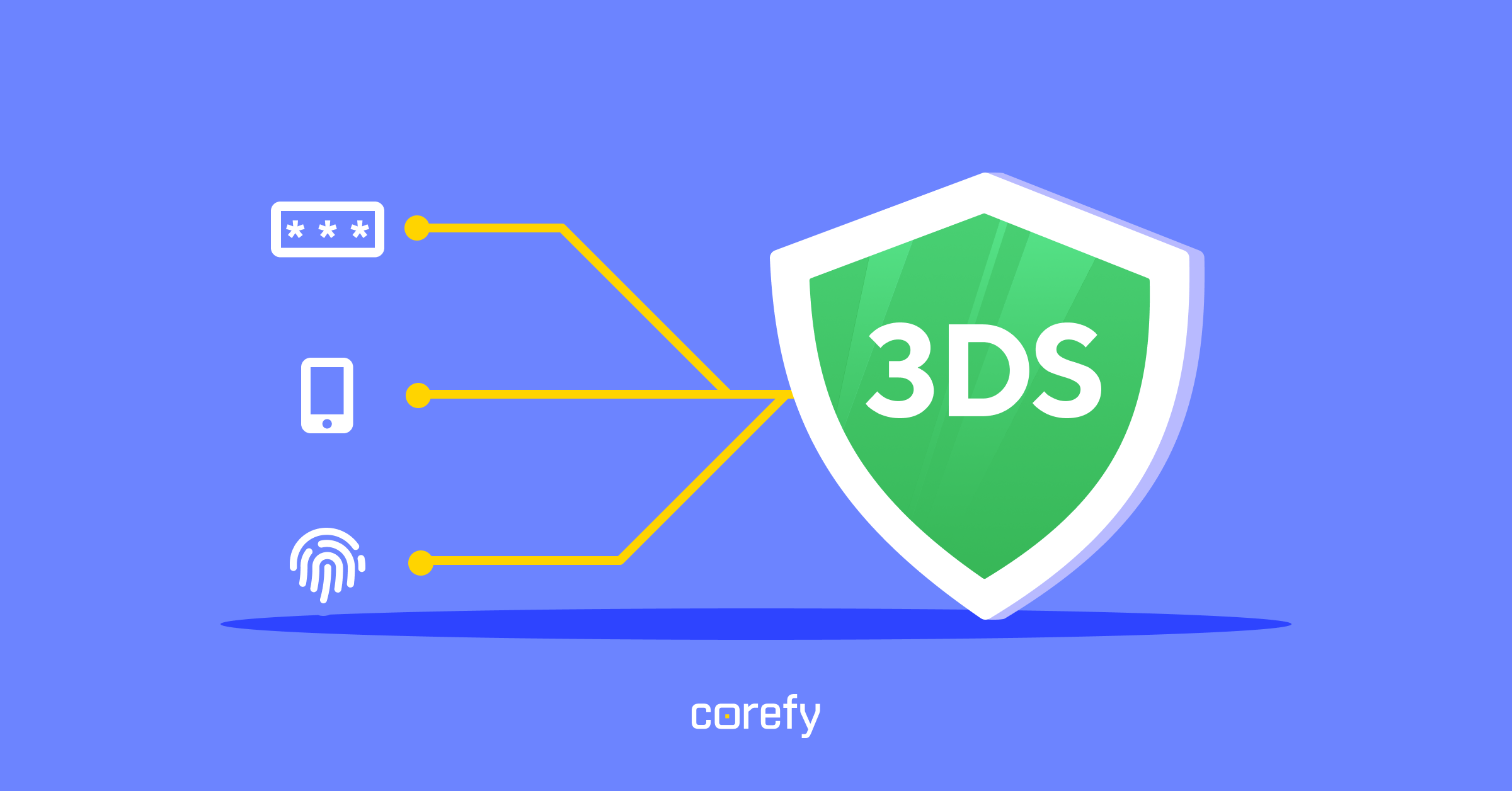

3d Secure Must Know Things For Businesses And Cardholders Corefy